Risk Management Guide For Advisors A risk management assessment is the structured process of identifying and evaluating potential risks that could negatively impact an organization s property and operations The systematic approach provides insights into threats and vulnerabilities allowing businesses to make informed decisions and implement effective risk mitigation strategies

Below you ll find 30 templates for risk management from a simple customizable process to SWOT and FMEA analyses to all sorts of ISO audits and miscellaneous inspection checklists When it comes to risk management audit and inspection processes are one of the most fundamental components of risk identification and analysis A master s degree in risk management equips professionals with the foresight to identify and mitigate various risks helping prepare them for leadership and managerial jobs A bachelor s

Risk Management Guide For Advisors

Risk Management Guide For Advisors

Risk Management Guide For Advisors

https://netadminworld.com/Images/RiskManagement/risk_management.png

Regulatory services play a critical role in helping businesses and organizations navigate the complex and evolving landscape of government regulations These services are essential for maintaining legal compliance managing risks and ensuring that organizations operate ethically and responsibly within their respective industries Credit risk

Pre-crafted templates use a time-saving solution for developing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for numerous individual and expert tasks, including resumes, invites, flyers, newsletters, reports, presentations, and more, simplifying the material creation procedure.

Risk Management Guide For Advisors

Ultimate Security Risk Management Guide BOS Security

Basics Of Risk Management For Beginners Module WikiFinancepedia

Risk Management Framework And Why It Matters In Business FourWeekMBA

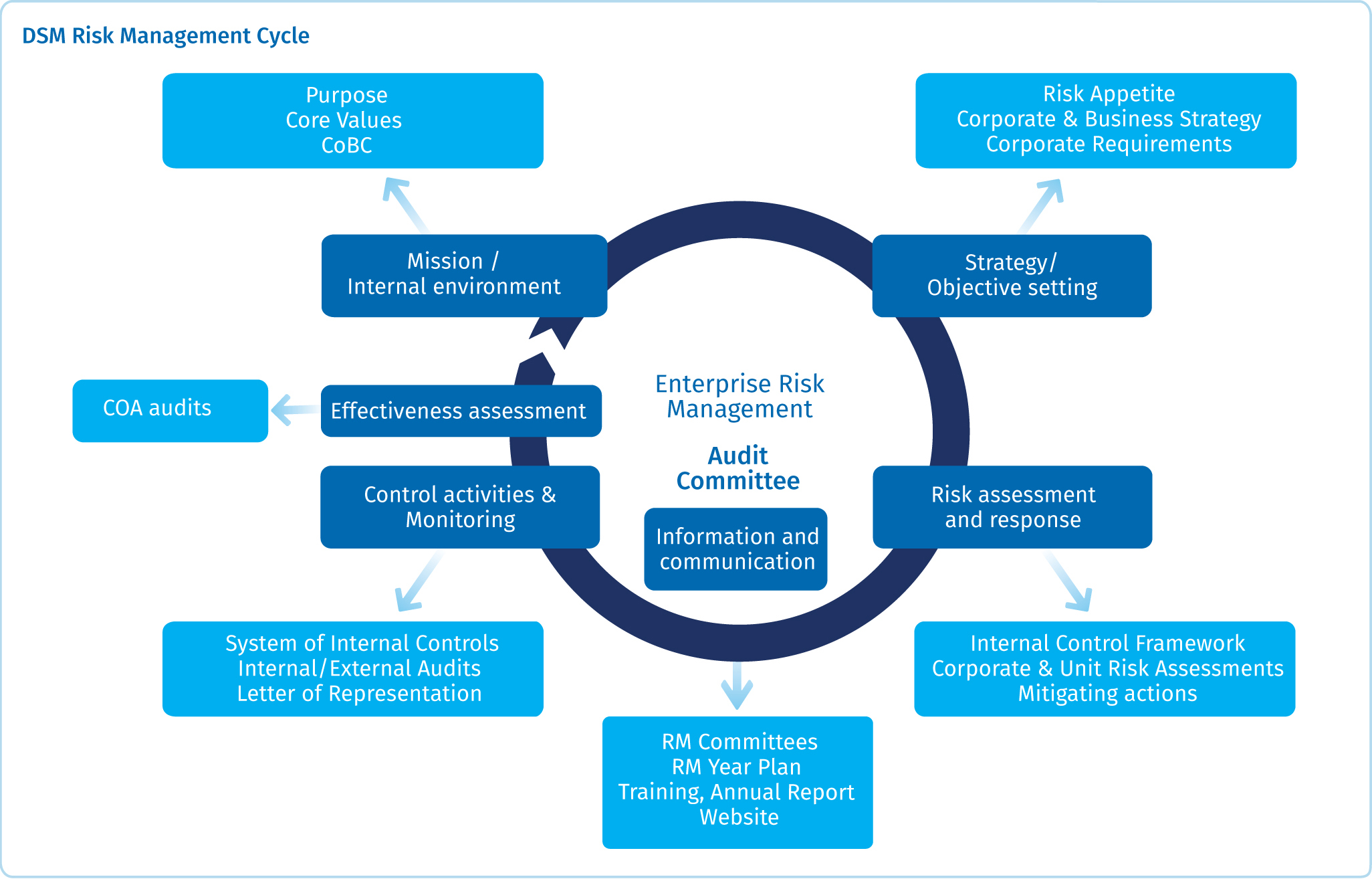

Risk Management DSM Annual Report

_19557135c2.png)

Risk Management Guide For Startups What Are The Key Tech Risks And How

The Construction Risk Management Guide For 2019 Construction Citizen

https://rpc.cfainstitute.org/en/research/reports/investment-risk-profiling

John E Grable Bob Dannhauser CFA FRM CAIA This report provides a comprehensive framework that financial advisors can use when developing investment risk profiles for clients The guidelines can also help advisors incorporate commercial risk assessment tools and meet regulatory requirements

https://www.cfainstitute.org/-/media/documents/survey/investment-risk-profiling.ashx

Essentially all risk profiling tools in the marketplace can be used to meet regulatory customer due diligence requirements 2 In addition nearly all existing tools provide a basis for investor advisor risk return discussions As a result financial advisors who are merely looking for a regulatory compliance tool have

https://www.investmentnews.com/how-to-make-risk-management-work-for-advisers-208022

Practice Management How to make risk management work for advisers Instead of engaging in a debate over which 30 year old approach to risk management is better advisers can jump to the best

https://rsmus.com/services/risk-fraud-cybersecurity/risk-advisory.html

Risk advisory consulting services Growing companies face ever evolving risks but with guidance from RSM your approach to risk management can be much more than a preventative measure it can be a strategic driver

https://www.financial-planning.com/list/evaluating-client-risk-9-takeaways-for-advisors

Software tools such as Riskalyze allow an advisor to take a client through various scenarios and answer questions along the way to assess risk tolerance Still risk assessment only works if the

As a practicing executive and project management trainer I asked my colleagues and trainees how risk management works in their companies The most popular answers were We budget 30 for risk Risk management involves determining the potential risks of an activity and coming up with strategies for avoiding or managing those risks Risks may be regulatory financial reputational

Here are 12 key elements of managing a financial advisor practice Manage client relationships Building and maintaining strong relationships with clients is fundamental This involves understanding client financial goals risk tolerance and needs as well as tailoring personalized and strategies to help them reach objectives