Payroll Limitation Guide For Owners And Officers 2022 Payroll Limitations Rates are subject to change annually For more information contact our Premium Audit Department at 225 389 5822 888 884 5822 or premiumaudit lubawc As of November 2021

2022 IRC REF Salary Deferral pretax Limits 401 k 403 b SEP SIMPLE Plans State local govt tax exempts 401 k catch up contributions Other catch up contributions Section 415 Annual Benefits Limits Defined benefit plans Defined contribution plans Compensation Limits Qualified plans Collectively bargained Governmental plans Rates are subject to change annually For more information contact our Premium Audit Department at 225 389 5822 888 884 5822 or premiumaudit lubawc As of August 2022 Owne

Payroll Limitation Guide For Owners And Officers 2022

Payroll Limitation Guide For Owners And Officers 2022

Payroll Limitation Guide For Owners And Officers 2022

https://itsourcecode.com/wp-content/uploads/2021/07/ER-Diagram-for-Payroll-Management-System.png

Payroll limitation is a limitation on the amount of payroll for certain classifications used for the development of premium On This Page Additional Information In workers compensation insurance payroll limitations typically apply only to sole proprietors executive officers partners and certain noted classifications

Pre-crafted templates use a time-saving option for creating a diverse variety of documents and files. These pre-designed formats and layouts can be made use of for different individual and expert jobs, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the content development procedure.

Payroll Limitation Guide For Owners And Officers 2022

Payroll Outsourcing An Ultimate Guide

Qatar Police Prepare For FIFA 2022 With Manchester Police The Life Pile

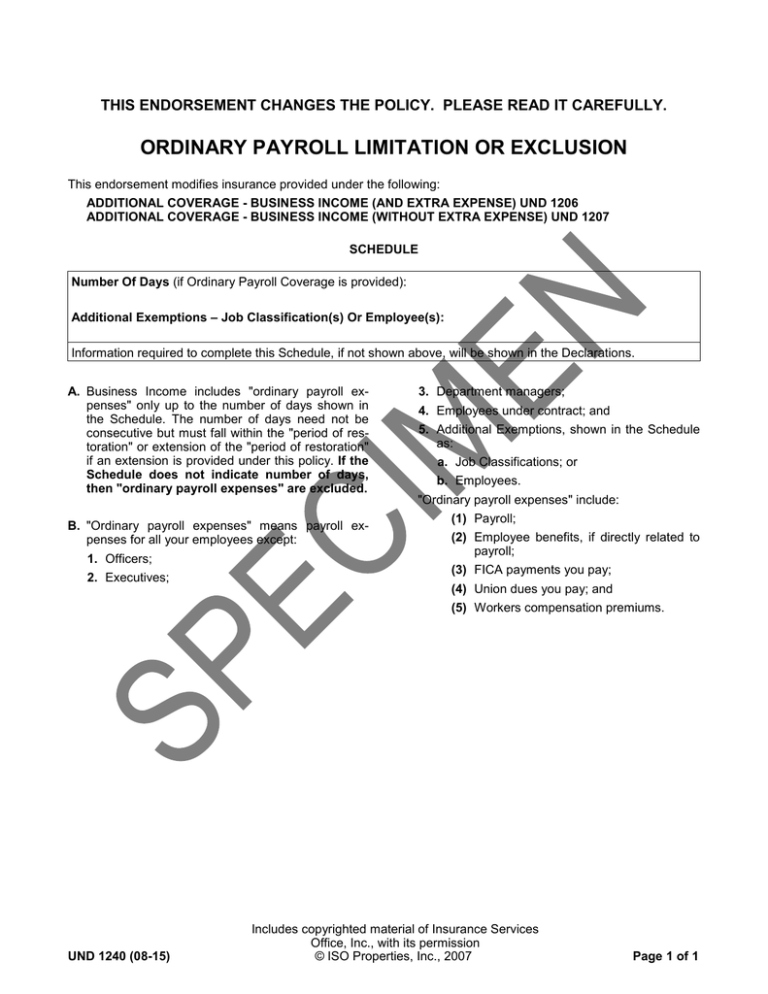

Ordinary Payroll Limitation Or Exclusion

Ford Nationals 60th Anniversary Show Details Lotus Cortina Register

Payroll Accounting Limitations Of Payroll Accounting

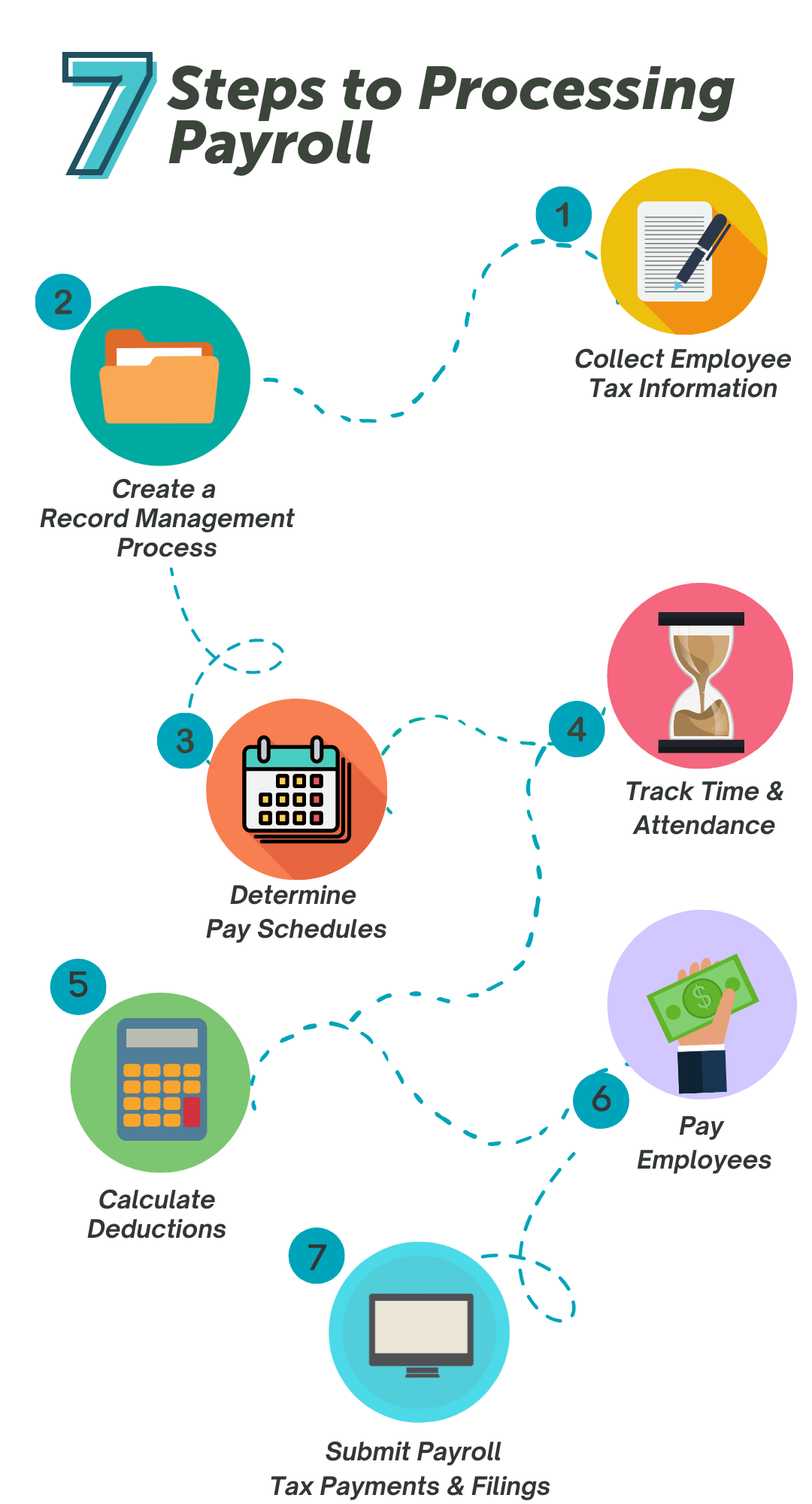

How To Process Payroll A 7 Step Guide APS Payroll

https://www.omega4agents.com/wp-content/uploads/Officer-Min-Max-Payrolls-by-State.pdf

Payroll Limitation Guide for Owners and Officers Refer to state Workers Compensation laws and administrative regulations for complete details on statutory provisions regarding determination of payroll for executive officers partners sole proprietors members managers of limited liability companies or other individuals

https://icwgroup.com/workers-compensation/library/icw-group-work-comp-maximum-payroll.pdf

Premium Audit Oficers Partners Annual Maximum Payrolls FL Construction MIN 26 000 NY Construction codes MAX 135 200 NV Sole proprietor or partner electing higher benefits 21 600 TN Construction codes MIN 28 600 MAX 81 000 NH Oficers of unincorporated assc MIN 15 600 MAX 130 000

https://www.icrb.net/references/payroll-limitations-for-owners-and-executive-officers/

Payroll Limitations for Owners and Executive Officers For calculating premium our rules place an advisory minimum and maximum payroll for executive officers and beginning for 2012 also for sole proprietors partners and limited liability company LLC members The limitations apply to the average weekly payroll

https://www.lwcc.com/news/lwcc-announces-4-2-rate-reduction-for-2022-and-ncci-miscellaneous-values-payroll-limitations

Additionally LWCC has adopted the National Council on Compensation Insurance NCCI miscellaneous values and the officer and owner payroll limitations for all new and renewal business bound on or after the effective date of May 1 2022 This information can be found on LWCC Interactive under the Agency Info tab

https://www.ncci.com/enterprise/search/pages/all_results.aspx?k=payroll+limitation+guide+for+owners&app

Search payroll limitation guide for owners Search Results Want to search NCCI s Atlas Initiative transformed manuals Click here to learn more

D Payroll Limitations 1 Specific limitations may apply to a Payroll for executive officers members of limited liability companies partners and sole proprietors b Classifications with notes that indicate payroll limitations 2 Payroll limitations apply after any exclusions of extra pay for overtime refer to Rule 2 C 2 a 3 The payroll limitation which is a function of New York State s average weekly wage is updated on an annual basis Please be advised that effective July 1 2022 the payroll limitation will be 1 688 19 per week

PREMIUM AUDIT 2023 OFFICERS PARTNERS ANNUAL PAYROLL LIMITATIONS FL Construction MIN 28 600 NY Construction codes MAX 87 786 NV Sole proprietor or partner electing higher benefits 21 600 TN Construction codes MIN 28 600 MAX 85 800 NH Oficers of unincorporated assoc MIN 18 200 MAX 145 600