Irs Conservation Easement Audit Techniques Guide Conservation Easement Audit Techniques Guide By IRS This guide has been designed by the IRS to help private landowners create valid and enforceable conservation easements that will be upheld through an audit Download Full Article

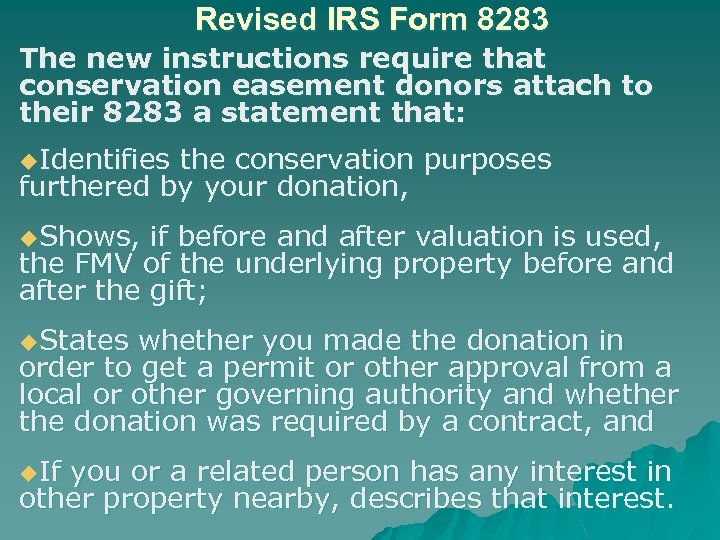

1 170A 14 d 4 iv B A conservation easement that merely limits the number of lots that the acreage is divided into does not satisfy the open space requirement of section 170 h Turner v Commissioner 126 T C 299 2006 The legislative history underlying section 170 h shows that Congress did not intend for every easement to qualify 1 Appraisals For appraisals the revised ATG now directs the examiner to focus on ensuring that the appraisal a Describes exactly what is being donated If the appraisal only values the underlying fee title and does not provide a value for the conservation easement then it is not a qualified appraisal as discussed in Costello v

Irs Conservation Easement Audit Techniques Guide

Irs Conservation Easement Audit Techniques Guide

Irs Conservation Easement Audit Techniques Guide

https://nonprofitquarterly.org/wp-content/uploads/2020/01/easement-sign.jpg

On November 4 2016 the IRS updated its Conservation Easement Audit Techniques Guide CE Audit Guide for the first time since March 15 2012 According to the

Pre-crafted templates offer a time-saving solution for creating a diverse variety of documents and files. These pre-designed formats and layouts can be made use of for numerous personal and expert projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, simplifying the material development process.

Irs Conservation Easement Audit Techniques Guide

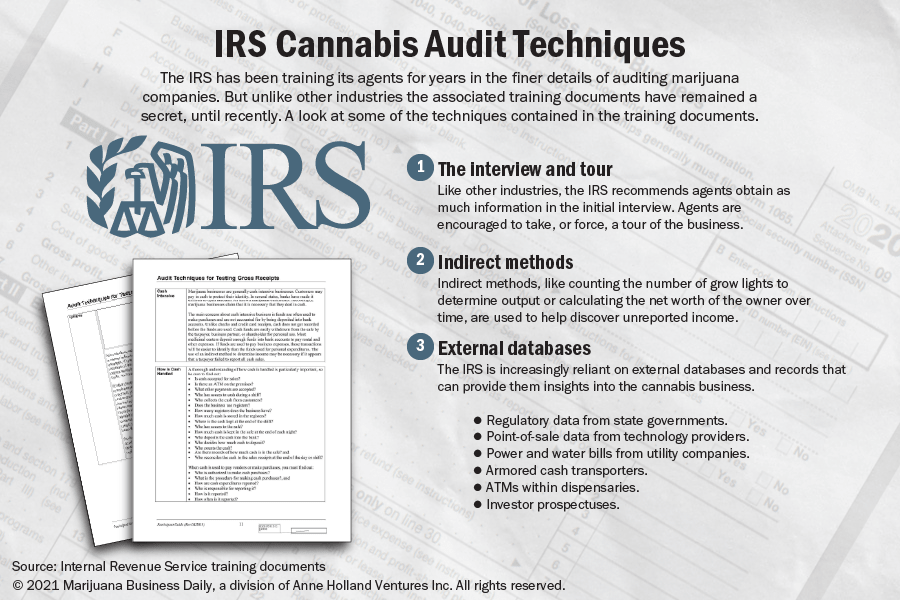

Confidential IRS Marijuana Guide Details Audit Procedures For Agents To

Manuel Lizardo Posted On LinkedIn

IRS Audit Techniques Guides Available To Taxpayers Roger Rossmeisl CPA

Conservation Easements And Appraisals Congressional Hearings On

IRS Audit Techniques Guides Clues If Business Is Audited

PDF Conservation Easement Audit Techniques Guidednr maryland gov met

https://www.irs.gov/businesses/small-businesses-self-employed/audit-techniques-guides-atgs

This audit techniques guide ATG has been developed to provide guidance to Revenue Agents and Tax Compliance Officers in pursuing the application of IRC 183 Activities Not Engaged in for Profit sometimes referred to as the hobby loss rule Aerospace Industry Publication Date 01 2005

https://www.irs.gov/pub/irs-utl/conservation_easement.pdf?gclid=deleted

Conservation Easement Audit Techniques Guide Revision Date January 24 2018 Note This document is not an official pronouncement of the law or positionof The National Register of Historic Places the Service and cannot be used cited or relied upon as such This guide is current through the publication date

https://news.bloombergtax.com/daily-tax-report/irs-pub-conservation-easement-audit-technique-guide-irc-170

Conservation Easement Audit Technique Guide IRC 170 Revised Publication 5464 Conservation Easement Audit Technique Guide providing guidance for the examination of charitable contributions of conservation easements released November 19 The audit guide includes examination techniques and an overview of the valuation of conservation easements

https://www.irs.gov/pub/irs-wd/19-0018.pdf

Addresses in Treasury Regulation section 1 170A 17 and in the syndicated conservation easement listing notice Notice 2017 10 The IRS has made overvalued easements an enforcement priority IRS examiners are trained to look for overvaluation indicators which are nearly always the primary reason for commencing a conservation easement deduction

https://www.kaplankirsch.com/portalresource/lookup/wosid/cp-base-4-5326/overrideFile.name=/Understanding_the_IRS_Conservation_Easement_Audit_Guide.pdf

Open Space Scenic Enjoyment A conservation easement of open space preserved for the scenic enjoyment of the general public does not require physical access Visual access to or across the property by the general public is sufficient

Conservation Easements Audit Techniques Guide rev 11 4 2016 pg 24 17 Section 170 a 1 18 Section 170 a 1 Reg 1 170A 1 c 1 19 Reg 1 170A 1 c 2 20 Reg 1 170A 14 h 3 i 21 Internal Revenue Service Conservation Ease ment Audit Techniques Guide rev 11 4 2016 pg 41 22 Internal Revenue Service Conservation Ease ment Oct 28 2019 The IRS has made it clear that it disfavors conservation easements From naming them a listed transaction to making their review a nationally coordinated issue to the U S

The purpose of this audit technique guide ATG is to provide guidance for the examination of charitable contributions of conservation easements Users of this guide will learn about the general requirements for charitable contributions and additional requirements for contributions of conservation easements