Vertex Payroll Tax Guide 2023 Vertex e Invoicing partnering with Pagero simplifies indirect tax compliance and streamlines Continuous Transaction Controls CTC requirements Isaac M O Bannon Oct 23 2023

2023 Payroll Tax Rates Taxable Wage Limits and Maximum Benefit Amounts Unemployment Insurance UI The 2023 taxable wage limit is 7 000 per employee How to Use This Guide The information in this guide provides information you need to know or do as an employer when to register who is Vertex is the leading and most trusted provider of comprehensive integrated tax technology solutions having helped 10 000 businesses since 1978 Payroll Tax Industry solutions Blog Dec 12 2023 Mind the VAT gap and take a closer look Peter Boerhof examines the EU s latest VAT Gap report Read Time 2 Mins Read More Blog Dec 11

Vertex Payroll Tax Guide 2023

Vertex Payroll Tax Guide 2023

Vertex Payroll Tax Guide 2023

https://harriscpas.com/wp-content/uploads/2020/03/payroll-tax-credits-e1585251131836.jpeg

Employer s Tax Guide or the IRS irs gov 4 New employers pay 3 4 percent for a period of two to three years 5 Refer to the 2023 Federal and State Payroll Taxes DE 202 Rev 12 12 22 Author EDD Employment Development Department State of California Keywords de202

Pre-crafted templates offer a time-saving option for producing a varied variety of documents and files. These pre-designed formats and designs can be made use of for different personal and expert jobs, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, enhancing the material production procedure.

Vertex Payroll Tax Guide 2023

Payroll Tax EN JPayroll Software Payroll HRIS

Payroll Tax Holiday Plays Into GOP Plans To Cut The Safety Net Crooks

CARES Act Payroll Tax Deferral For Employers

Automate Payroll Tax Calculation Vertex Inc

Vertex Announces FCSA Compliant PAYE Payroll Solution Vertex IT Solutions

2023 Calendar With Holidays Printable 2023 January Calendars Fatisill

https://www.vertexinc.com/sites/default/files/2022-03/vertex-payroll-tax-data-sheet.pdf

Access to our payroll tax calculation reference guides that provide in depth explanations of the applicable taxes calculation methods and calculation examples for each country state province and local jurisdiction in the U S and Canada Complex Calculations

https://www.vertexinc.com/solutions/products/vertex-payroll-tax-q-series

Vertex Payroll Tax Q Series Leverage a powerful payroll tax calculation engine for reliable gross to net payroll calculations that reduce risk and improve efficiency LEARN MORE Automated payroll tax calculation from the tax technology leader

https://www.irs.gov/publications/p15

What s New Social security and Medicare tax for 2023 The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after March 31 2021 and before October 1 2021 is 6 2 each for the employer and employee or 12 4 for both

https://www.vertexinc.com/resources/resource-library/guide-post-pandemic-payroll-tax

A Guide to Post Pandemic Payroll Tax Now is the time to re examine how you deliver tax capabilities to your customers Share There is no question that US payroll tax has become significantly more complex as jurisdictions deal with making up lost revenue and budget shortfalls caused by the pandemic

https://docs.oracle.com/en/cloud/saas/human-resources/23d/fauct/implementing-us-courtesy-taxes.pdf

Calculation Guide for the United States Vertex Payroll Tax Q Series These tax withholding rules determine the resident wage accumulation rules available to you The federal and state withholding forms provide the default tax withholding info for the payroll process However as their employer you may not be required to withhold resident state

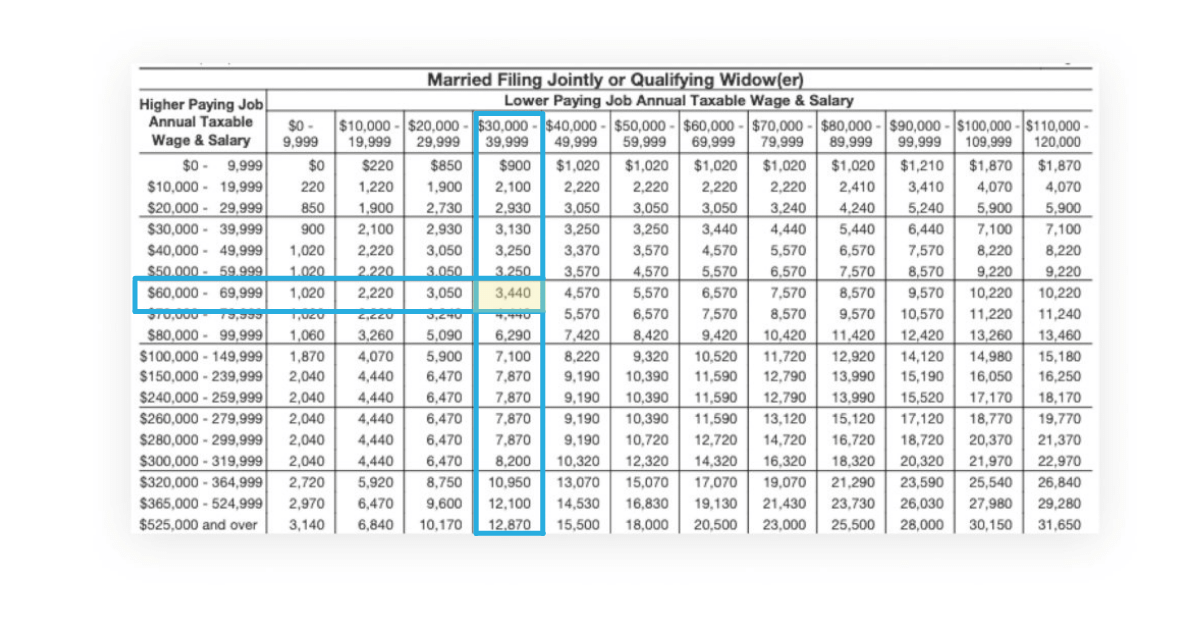

Automating Payroll Tax Calculations When it comes to payroll tax calculations your employees expect 100 percent thoroughness and accuracy But the complexity of this critical business activity creates a difficult and demanding process for payroll tax professionals Vertex Payroll Tax Q Series offers a powerful solution with comprehensive 2023 Tax Reference Guide With tax season upon us we wanted to share an Easy Reference Tax Guide for 2023 Included are the brackets for Federal Income Tax Alternative Minimum Tax Long Term Capital Gains Tax Standard Deduction Retirement Plan Contribution Limits Traditional IRA Roth IRA Contributions Education Tax Credit Incentives

Vertex provides solutions that can be tailored to specific industries for major lines of indirect tax including sales and consumer use value added and payroll Headquartered in North America and with offices in South America and Europe Vertex employs over 1 400 professionals and serves companies across the globe