Payroll Limitation Guide For Owners And Officers 2023 Manage Ownership is a web based software tool that allows an employer or a producer who is authorized by the employer to complete and submit the WCRIBMA Request for Ownership Information Form ERM Form electronically to the WCRIBMA through our website Frequently Used Values Federal Tax Identification Numbers FEIN

Executive Officers and Partners Certain business owners who meet the statutory requirements may elect to exclude themselves from workers compensation insurance coverage including Officers and members of boards of directors of certain types of corporations The California Labor Code Sections 3351 and 3352 governs the exclusion of these 2022 OFFICERS PARTNERS ANNUAL PAYROLL LIMITATIONS FL Construction MIN 26 000 NY Construction codes MAX 82 918 NV Sole proprietor or partner electing higher benefits 21 600 TN Construction codes MIN 28 600 MAX 81 120 NH Oficers of unincorporated assc MIN 15 600 MAX 130 000

Payroll Limitation Guide For Owners And Officers 2023

Payroll Limitation Guide For Owners And Officers 2023

Payroll Limitation Guide For Owners And Officers 2023

https://cpahalltalk.com/wp-content/uploads/2016/06/image-11.jpeg

Payroll limitation is a limitation on the amount of payroll for certain classifications used for the development of premium On This Page Additional Information In workers compensation insurance payroll limitations typically apply only to sole proprietors executive officers partners and certain noted classifications

Pre-crafted templates provide a time-saving service for developing a diverse variety of documents and files. These pre-designed formats and layouts can be used for numerous personal and expert jobs, including resumes, invitations, flyers, newsletters, reports, discussions, and more, improving the material development process.

Payroll Limitation Guide For Owners And Officers 2023

Browse Our Example Of Employee Payroll Ledger Template For Free

A Guide To Running Payroll For Small Business Owners Enkel

Tax Credit 2023 2023

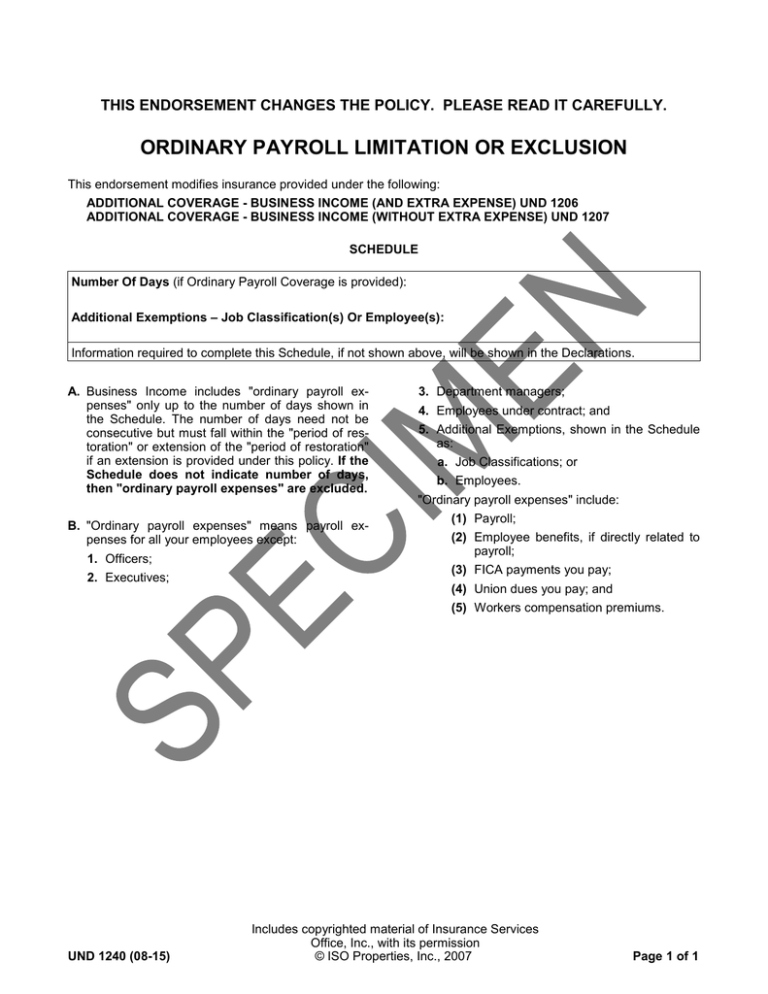

Ordinary Payroll Limitation Or Exclusion

Best Payroll Software For Small Businesses In India Razorpay Payroll

Payroll Accounting Limitations Of Payroll Accounting

https://www.omega4agents.com/wp-content/uploads/Officer-Min-Max-Payrolls-by-State.pdf

Payroll Limitation Guide for Owners and Officers Refer to state Workers Compensation laws and administrative regulations for complete details on statutory provisions regarding determination of payroll for executive officers partners sole proprietors members managers of limited liability companies or other individuals

https://static.store.tax.thomsonreuters.com/static/relatedresource/final_factfinder_2023.pdf

2022 IRC REF Salary Deferral pretax Limits 401 k 403 b SEP SIMPLE Plans State local govt tax exempts 401 k catch up contributions Other catch up contributions Section 415 Annual Benefits Limits Defined benefit plans Defined contribution plans Compensation Limits Qualified plans Collectively bargained Governmental plans

https://www.icrb.net/references/payroll-limitations-for-owners-and-executive-officers/

Payroll Limitations for Owners and Executive Officers For calculating premium our rules place an advisory minimum and maximum payroll for executive officers and beginning for 2012 also for sole proprietors partners and limited liability company LLC members The limitations apply to the average weekly payroll

https://www.lwcc.com/resources/2022-ncci-miscellaneous-values-payroll-limitations-sumary

Articles LWCC uses the National Council on Compensation Insurance NCCI Miscellaneous Values and the Ownership Payroll Limitation Summary for all new and renewal business

https://omega4agents.com/wp-content/uploads/Officer-Mins-Max-Payrolls-by-State.pdf

Payroll Limitation Guide for Owners and Officers Refer to state Workers Compensation laws and administrative regulations for complete details on statutory provisions regarding determination of payroll for executive officers partners sole proprietors members managers of limited liability companies or other individuals

Owner Executive Officer Payroll Limitations Louisiana Corporations LLCs Minimum Maximum 49 400 for policies with effective dates starting 5 1 21 4 30 22 145 600 for policies with effective dates starting 5 1 21 4 30 22 Sole Proprietors Partnerships The payroll limitation which is a function of New York State s average weekly wage is updated on an annual basis Please be advised that effective July 1 2022 the payroll limitation will be 1 688 19 per week

Many states limit benefits to a certain amount per week and number of weeks The calculation used for company owners and officers varies by state and can change each year 8810 is a standard exception code so division of payroll is not allowed The only exception to this rule is for payroll for covered business owners in which 10