2023 Tax Reference Guide Pdf Those who got 3 600 per dependent in 2021 for the CTC will if eligible get 2 000 for the 2022 tax year For the EITC eligible taxpayers with no children who received roughly 1 500 in 2021 will now get 500 in 2022 The Child and Dependent Care Credit returns to a maximum of 2 100 in 2022 instead of 8 000 in 2021

2023 Tax Reference Guide 3 Below table effective as of Jan 1 2022 Use to calculate required minimum distributions from IRAs and qualified plans during owner s life Do not use this table if owner has spousal beneficiary more than 10 years younger Instead use Joint Life Table from IRS Pub 590 Uniform Lifetime Table 14 Taxpayer s Age Net Investment Income Tax 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately 95 350 182 100

2023 Tax Reference Guide Pdf

2023 Tax Reference Guide Pdf

2023 Tax Reference Guide Pdf

https://www.claruswealthatplumcreek.com/sites/default/files/users/claruswealth/2020 Tax Reference_Page_2.png

2023 TAX REFERENCE GUIDE IR eneficiar ptions Uniform Lifetime Table Use to calculate Required Minimum Distributions from IRAs and qualified plans during owner s life Do not use this table if owner has spousal beneficiary more than 10 years younger Instead use Joint Life Table from IRS Pub 590 Taxpayer s Age Life Expectancy Taxpayer s Age Life

Templates are pre-designed files or files that can be utilized for different purposes. They can conserve time and effort by supplying a ready-made format and design for producing different sort of content. Templates can be utilized for personal or expert tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

2023 Tax Reference Guide Pdf

2023 Taxes Clarus Wealth

Index Of wp content uploads 2017 02

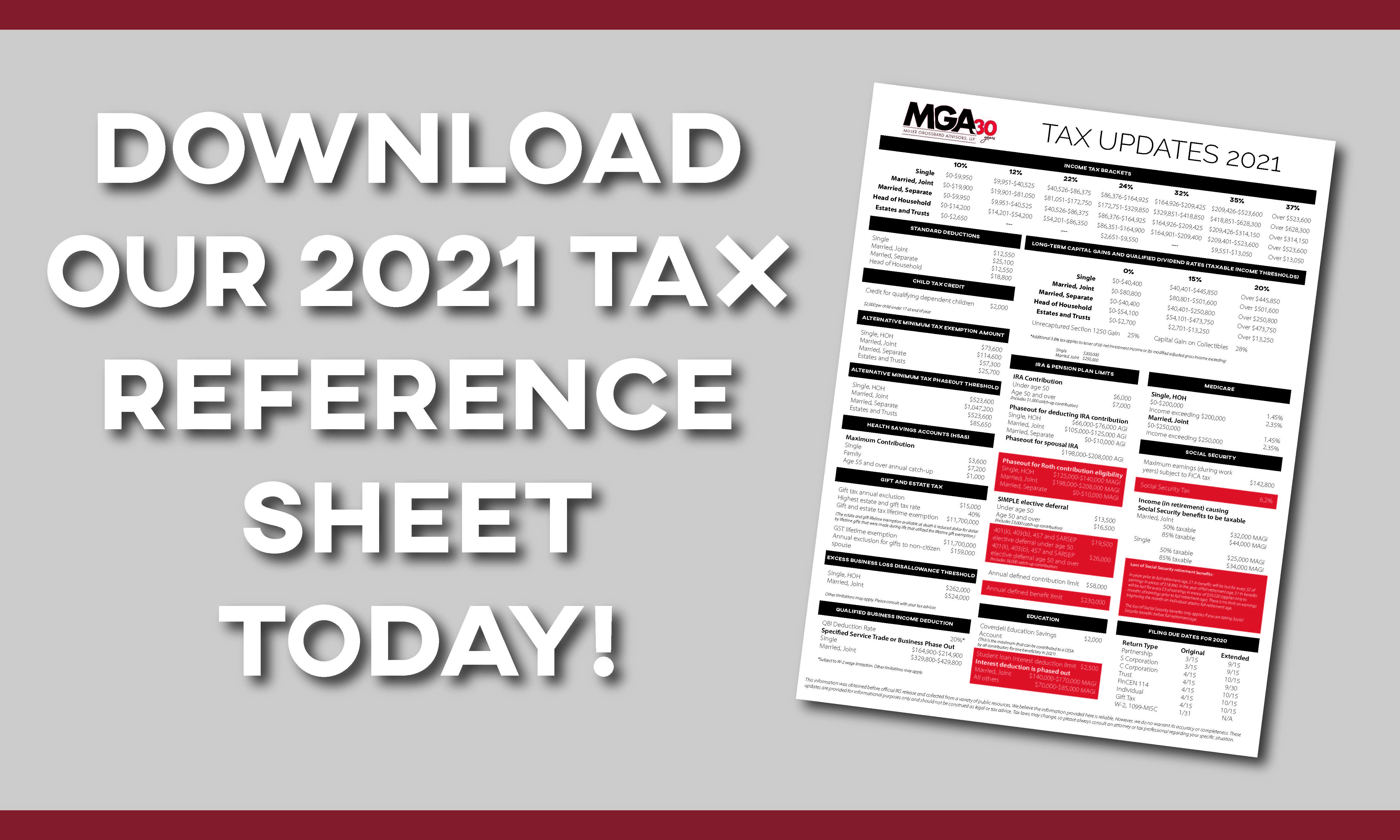

Sars 2021 Tax Tables Pocket Guide Brokeasshome

2016 Tax Reference Guide

Tax Reference Guide And The Latest Tax Deadlines

Tax Payment Deadline Delayed By 90 Days Slattery Holman P C

https://www.schwabassetmanagement.com/content/2023-tax-reference-guide

2023 Tax Reference Guide November 30 2022 This quick reference guide is a great resource for 2023 planning discussions with clients summarizing tax deductions tax credits and contributions to retirement plans found in various federal tax publications and websites

https://assets.bbhub.io/bna/sites/9/2023/01/2022_2023-Quick-Tax-Reference-Guide.pdf

2022 2023 As of January 2023 Bloomberg Tax is pleased to provide you with our 2022 2023 Quick Tax Reference Guide a practical resource to help you plan and comply in the upcoming year From a straightforward tax transaction to the most complex tax issues you can rely on Bloomberg Tax

https://static.fmgsuite.com/media/documents/21e91981-bc91-4bd1-a834-f1d0767c7d7d.pdf

2023 TAX REFERENCE GUIDE Federal Income Taxes MARRIED FILING JOINTLY SURVIVING SPOUSES Taxable Income Tax Rate 0 22 000 10 0 22 001 89 450 12 0 89 451 190 750 22 0 190 751 364 200 24 0 364 201 462 500 32 0 462 501 693 750 35 0 693 751 37 0 HEAD OF HOUSEHOLD Taxable Income Tax Rate

https://pro.bloombergtax.com/quick-tax-reference-guide/

This 2023 tax calendar is a reference guide of the most common forms and due dates for individuals businesses and tax exempt organizations View specific due dates by month for filing tax forms paying taxes and other actions required by federal tax law

https://www.pimco.com/handlers/displaydocument.ashx?fn=PIMCO_Tax%20Guide_ApprovedforInvestors.pdf&id=HJ5qpKe0z3R27SmRuw8JBlPSEJE6SWY1uRKCUFmPYN8OLPItR6pRe2QV5xh42zc1XeEfsw97PACmz64w0h4xeJwvi%2bsIaeQt64%2brYkHjcjJjunltFDp2ymw7BFIpubY7mlKj036TLXvQOmxQeZtrbTVUnog6L%2fSaiYUJSRjWPKtKJ0P%2bUG%2fOmcx2rRWhb%2b1E%2bakehsEF9uiXIzSJz1FtuWCBCjKQ4n3KNyfzusNe%2fjSZ7Sf4Aa7HQOkAGT9%2bT2GfIZ1tdJO1MLePjDJ0q88JxGR2Rt0jpERIgrln4DaDCzhWuN%2f%2f%2fz%2bSUwAVY1OgnUt6PqVKF32PqCUu3gFndlNQsAwjDQMme5n8IFkIFlYEqSgYEFzzob8eiN3o1JhbOaaAUmot2Tm842a7uyYSyvn%2b4dHmss6%2f%2bvSQOrr%2fZO7p1%2bkB9VnsIZd2iF%2f8HQlM1foj

2023 PIMCO EDUCATION Tax Reference Guide This popular guide highlights important and timely tax information for the 2023 tax year INDIVIDUAL INVESTORS SHOULD CONSULT THEIR TAX PROFESSIONAL Planning for 2023 Taxes

Tax Brackets for 2023 Taxable income i e income minus deductions and credits between Married Joint Surviving Spouses 0 22 000 22 001 89 450 89 451 190 750 190 751 364 200 364 201 462 500 Marginal Tax Rates 10 12 22 24 32 Standard Deduction Our complimentary 2022 2023 Quick Tax Reference Guide is a practical resource to help tax practitioners plan and review compliance related topics for the year including Filing dates and standard mileage rates Corporate tax rate schedule Individual tax rate schedules Social security and self employment tax limits and alternative minimum tax

2023 quick reference tax planning guide Retirement plans Elective deferrals 401 k 403 b 457 and SARSEPs 1 The FICA tax rate is comprised of two separate payroll taxes Employer and employee portion 6 20 for Old Age Survivors and Disability Insurance OASDI 2023 tax rate schedules If taxable income is Then the gross tax