2023 Quick Tax Reference Guide 2023 Form 1040 Quick Tax Method MFJ or QSS Taxable Income 0 22 001 89 451 190 751 364 201 462 501 693 751 0 11 001 44 726 95 376 182 101 231 251 578 126 0 15 701 59 851 95 351 182 101 231 251 578 101 0 11 001 44 726 95 376 182 101 231 251 346 876 Note 22 000 89 450 190 750 364 200 462 500

Bloomberg London Bloomberg Beta Gender Equality Index Communications Press Announcements Press Contacts Follow Facebook Instagram LinkedIn Twitter YouTube Products Bloomberg Terminal Data Trading Risk Indices Industry Products Bloomberg Law Bloomberg Tax 2023 QUICK TAX FACTS ESTATES AND TRUSTS CAPITAL GAINS AND DIVIDENDS Short term capital gains are gains from property held one year or less These gains are taxed at ordinary income tax rates

2023 Quick Tax Reference Guide

2023 Quick Tax Reference Guide

2023 Quick Tax Reference Guide

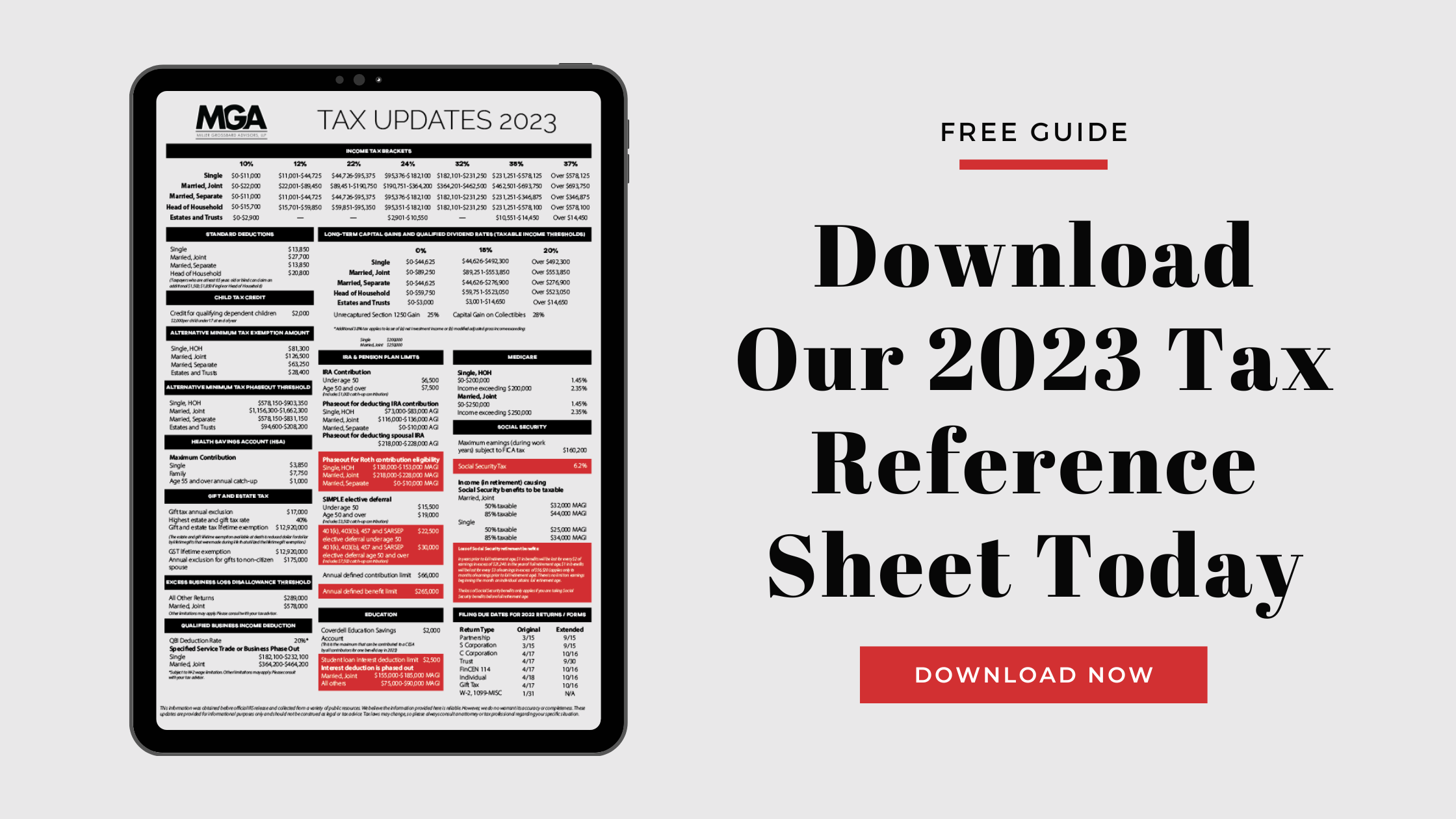

https://blog.mgallp.com/hubfs/2023 Tax Reference Guide Download.png#keepProtocol

This story is part of Taxes 2023 CNET s coverage of the best tax software tax tips and everything else you need to file your return and track your refund Our cheat sheet can serve as your guide

Pre-crafted templates offer a time-saving option for creating a varied series of documents and files. These pre-designed formats and designs can be made use of for different individual and expert jobs, including resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the content development process.

2023 Quick Tax Reference Guide

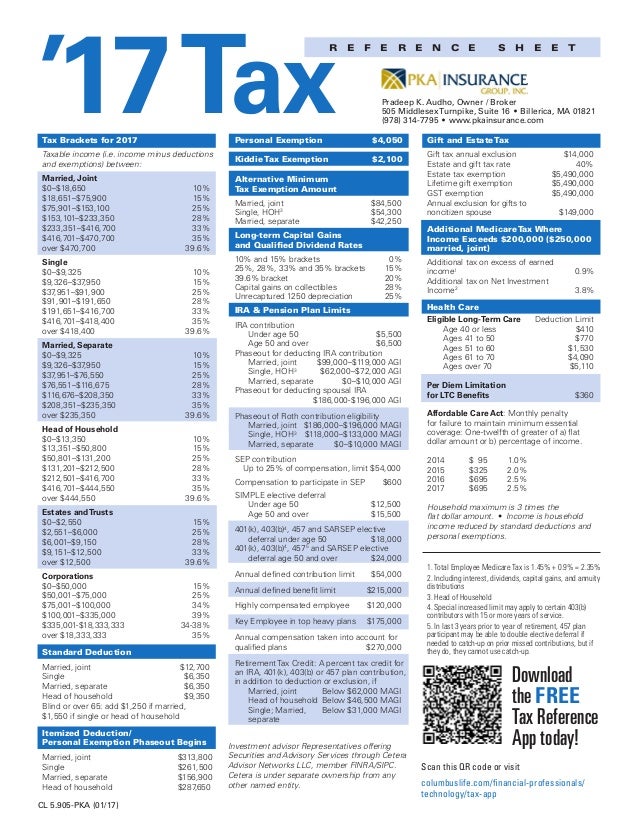

2018 Tax Reference Guide 2019 Quick Tax Reference Guide Pdf Tiaa

2022 Quick Tax Reference Guide Synergy Financial Solutions

2022 Quick Tax Reference Guide Jacob Gold Associates

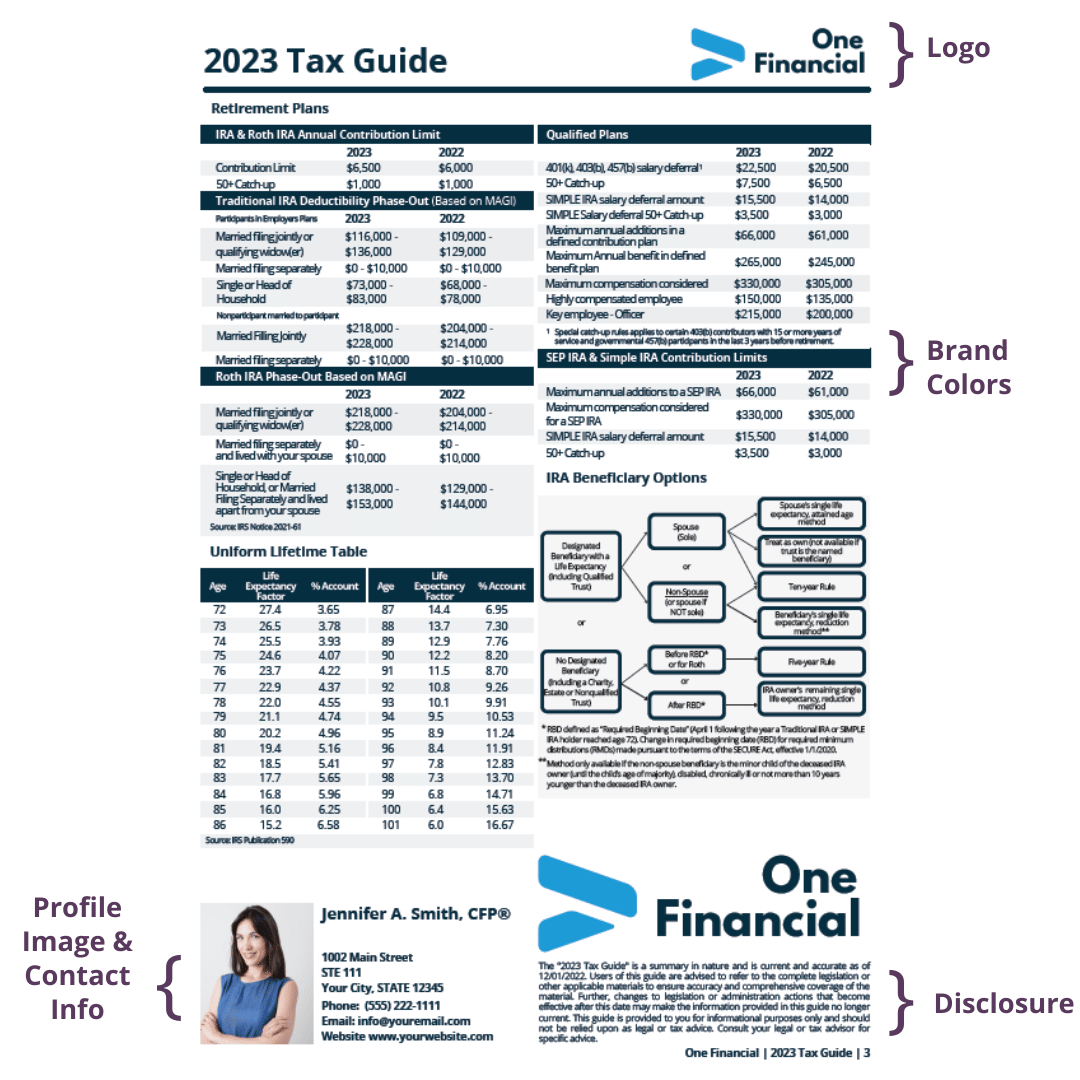

2023 Tax Guide PDF Custom Branded

Download The Tax Reference Guide For 2023

2023 Tax Reference Guide Clarus Wealth

https://pro.bloombergtax.com/quick-tax-reference-guide/

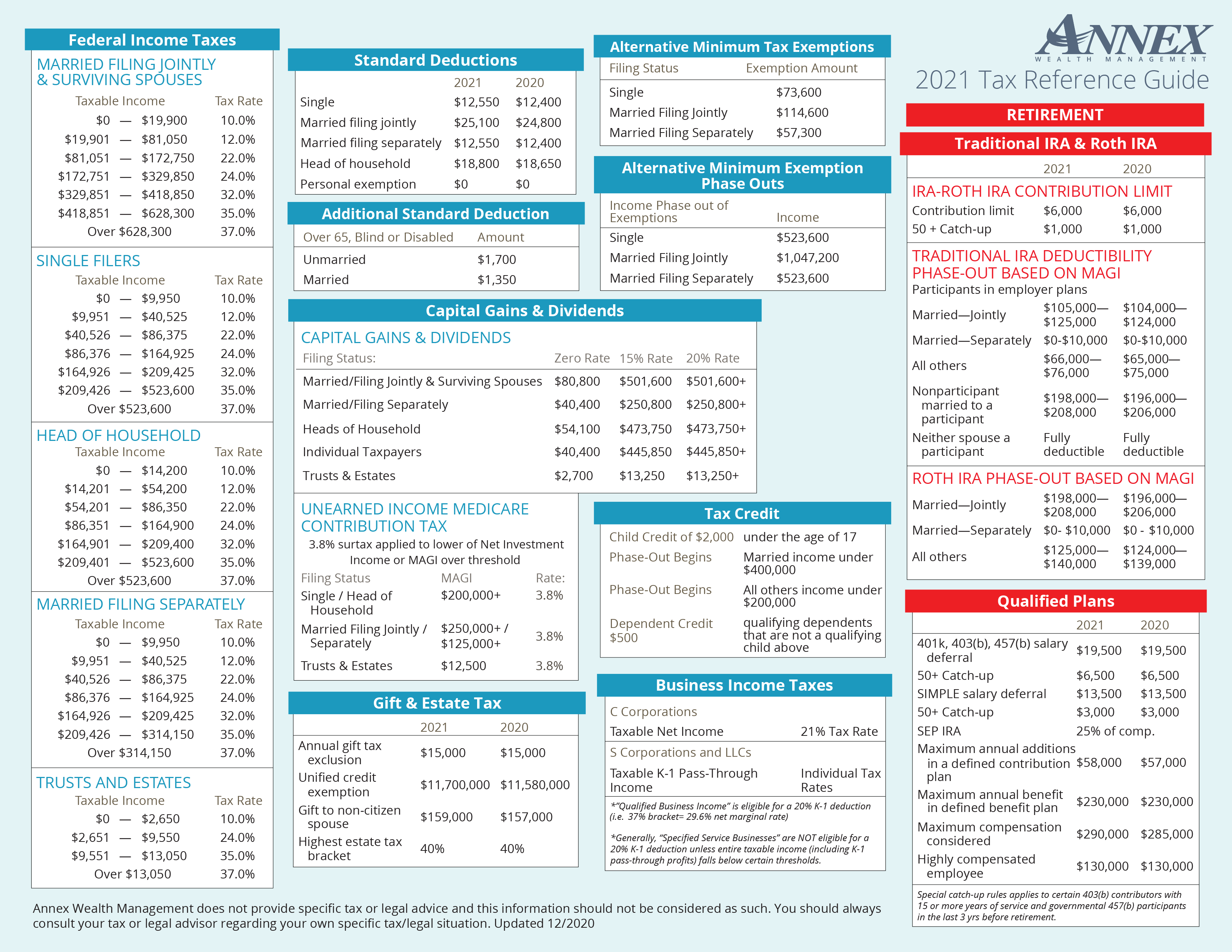

Bloomberg Tax is pleased to provide you with a digital version of our downloadable 2022 2023 Quick Tax Reference Guide a practical resource to help you plan and comply in the upcoming year

https://www.schwabassetmanagement.com/content/2023-tax-reference-guide

This quick reference guide is a great resource for 2023 planning discussions with clients summarizing tax deductions tax credits and contributions to retirement plans found in various federal tax publications and websites

https://www.usbank.com/dam/documents/pdf/wealth-management/2023-quick-reference-tax-guide.pdf

2023 quick reference tax planning guide Retirement plans

https://assets.bbhub.io/bna/sites/9/2023/01/2022_2023-Quick-Tax-Reference-Guide.pdf

2023 Note that the 20 deduction for qualified business income passed through to an individual from a pass through entity reduces the individual s effective tax rate Individual Tax Rate Schedules Married Individuals Filing Joint Returns and Qualifying Surviving Spouses Source Code Section 1 j Rev Proc 2021 45 2022

https://safemoneyresource.com/wp-content/uploads/2023/01/2023-Quick-Reference-Tax-Guide.pdf

2023 Quick Tax Reference Guide 1 2023 Quick Tax Reference Guide 1 Federal Income Taxes Single Taxpayer Federal Income Taxes Married Filing Jointly Taxable Income 0 11 000 11 000 44 725 44 725 95 375 95 375 182 100 182 100 231 250 231 250 578 125 Over 578 125 Tax Rate 10 12 22 24 32 35 37

Net Investment Income Tax NIIT is 3 8 of the lesser of the estate s or trust s undistributed net investment income or the excess of the estate s or trust s AGI over 13 700 The personal exemption was eliminated in the Tax Cuts and Jobs Act 2023 Quick Reference Tax Guide Description Table of Contents Related Resources 1040 Tax Organizer 2022 Your trusted 1040 tax book for quick reference tax answers The 1040 Quickfinder Handbook is your trusted source for quick reference to tax principles that apply when preparing individual income tax returns

Our 2023 Tax Pocket Guide which provides valuable updates and information including a chart of the most common tax rates for individuals and businesses is a concise snapshot that provides the basics to help you start the tax planning process This tax pocket guide is an essential resource that will help you evaluate and estimate your 2023 tax