2023 Quick Tax Reference Guide Pdf No more than 85 of your benefit will be taxable Provisional Income is your Adjusted Gross Income Tax Exempt Interest 50 of your Annual Social Security benefit 2023 QUICK TAX FACTS ESTATES AND TRUSTS CAPITAL GAINS AND DIVIDENDS Short term capital gains are gains from property held one year or less

2023 Quick Tax Reference Guide 2 Federal Income Taxes Trusts and Estates Taxable Income 0 2 900 Tax Rate 10 2 900 10 550 24 10 550 14 450 35 Over 14 450 37 Federal Income Taxes Standard Deductions 2023 2022 Single 13 850 12 950 Married Filing Jointly 27 700 25 900 Married Filing Sep 2023 Form 1040 Quick Tax Method MFJ or QSS Taxable Income 0 22 001 89 451 190 751 364 201 462 501 693 751 0 11 001 44 726 95 376 182 101 231 251 578 126 0 15 701 59 851 95 351 182 101 231 251 578 101 0 11 001 44 726 95 376 182 101 231 251 346 876 Note 22 000 89 450 190 750 364 200 462 500

2023 Quick Tax Reference Guide Pdf

2023 Quick Tax Reference Guide Pdf

2023 Quick Tax Reference Guide Pdf

https://static.twentyoverten.com/5c61d9bcf953531f1da82609/ug0SE9Jm10/Screen-Shot-2022-02-08-at-20625-PM.png

Over But not over Tax on excess Single Filers 0 11 000 0 00 10 0 2023 2022 Single 13 850 12 950 Married Filing Jointly 27 700 25 900 Head of Household 20 800 19 400 Source IRS gov 2023 Quick Tax Reference Guide Traditional and Roth IRA 2023 2022 IRA annual contribution limit Contribution limit 6 500 6 000 50 Catch up

Pre-crafted templates offer a time-saving service for creating a varied series of files and files. These pre-designed formats and designs can be used for different individual and expert tasks, including resumes, invitations, flyers, newsletters, reports, discussions, and more, simplifying the material creation process.

2023 Quick Tax Reference Guide Pdf

2022 2023 Quick Tax Reference Guide Bloomberg Tax Quick Reference

RTS Tax Reference Guide 2022 pdf DocHub

2022 Reference Guides LaCross Financial Advisors

Paid Ads For Social Media Essential Team

2018 Tax Reference Guide 2019 Quick Tax Reference Guide Pdf Tiaa

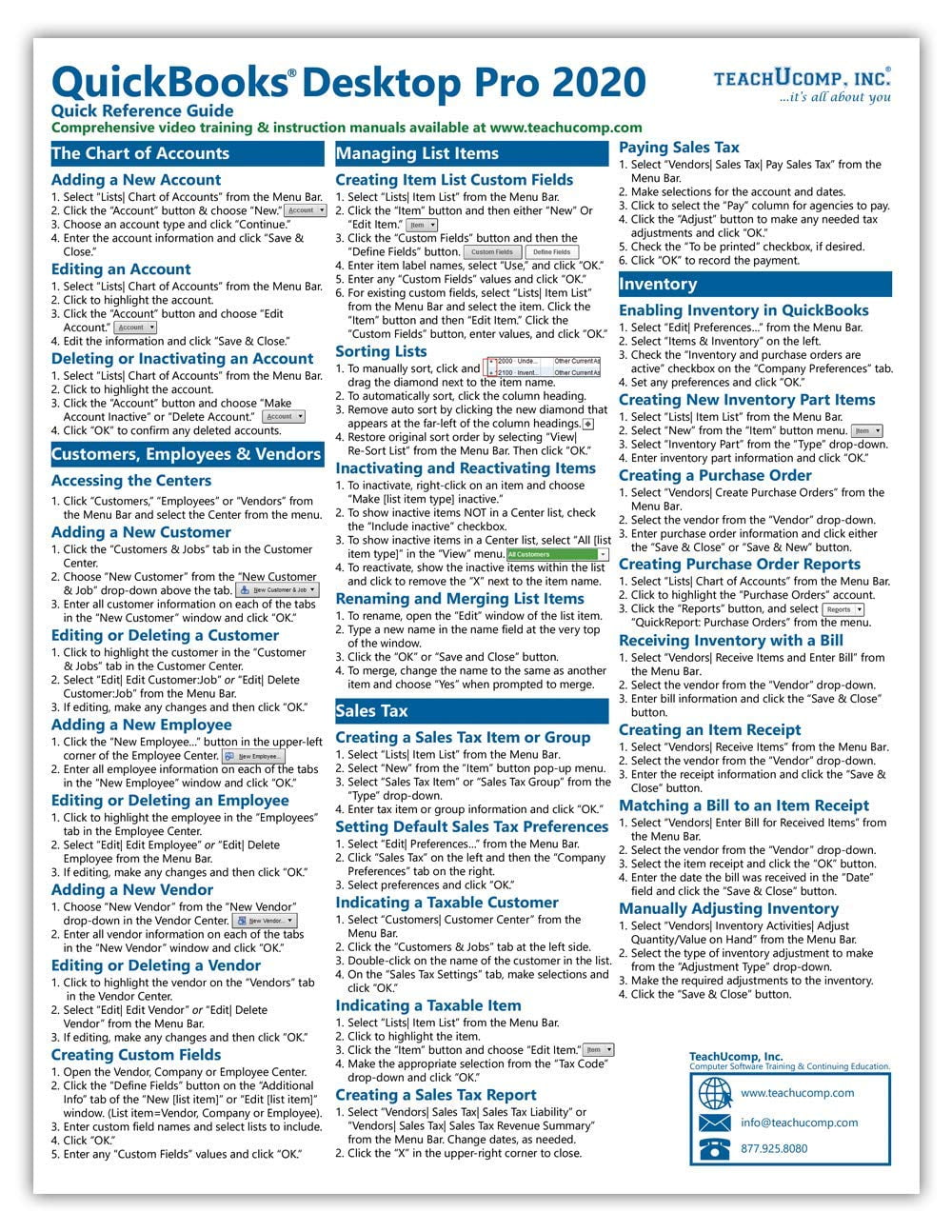

Quickbooks Instruction Manual Karmalop

https://assets.bbhub.io/bna/sites/9/2023/01/2022_2023-Quick-Tax-Reference-Guide.pdf

QUICKTAX REFERENCE 2022 2023 As of January 2023 Bloomberg Tax is pleased to provide you with our 2022 2023 Quick Tax Reference Guide a practical resource to help you plan and comply in the upcoming year From a straightforward tax transaction to the most complex tax issues you can rely on Bloomberg Tax

https://www.schwabassetmanagement.com/content/2023-tax-reference-guide

2023 Tax Reference Guide November 30 2022 This quick reference guide is a great resource for 2023 planning discussions with clients summarizing tax deductions tax credits and contributions to retirement plans found in various federal tax publications and websites

https://pro.bloombergtax.com/quick-tax-reference-guide/

2022 2023 Quick Tax Reference Guide Bloomberg Tax is pleased to provide you with a digital version of our downloadable 2022 2023 Quick Tax Reference Guide a practical resource to help you plan and comply in the upcoming year

https://www.usbank.com/dam/documents/pdf/wealth-management/2023-quick-reference-tax-guide.pdf

2023 quick reference tax planning guide Retirement plans Elective deferrals 401 k 403 b 457 and SARSEPs 1 The FICA tax rate is comprised of two separate payroll taxes Employer and employee portion 6 20 for Old Age Survivors and Disability Insurance OASDI 2023 tax rate schedules If taxable income is Then the gross tax

https://pro.bloombergtax.com/reports/quick-tax-reference-guide-pdf/

Our complimentary 2022 2023 Quick Tax Reference Guide is a practical resource to help tax practitioners plan and review compliance related topics for the year including Filing dates and standard mileage rates Corporate tax rate schedule Individual tax rate schedules Social security and self employment tax limits and alternative minimum tax

Net Investment Income Tax NIIT is 3 8 of the lesser of the estate s or trust s undistributed net investment income or the excess of the estate s or trust s AGI over 13 700 The personal exemption was eliminated in the Tax Cuts and Jobs Act 2023 Quick Reference Tax Guide Jan 26 2023 Taxes Medicare and Social Security are complex and ever changing so we ve created free guides with all the info you need all in one place Request copies customized with your logo too Contribution Limits Income Tax Rates Deductions and Credits Estate Gift Tax Rates and Exclusions

2023 13 850 1 850 27 700 1 500 13 850 20 800 0 Capital Gains Tax Rate Thresholds Capital Gains 0 15 20 Tax Rate Taxable Income Up to 89 251 to Over 89 250 553 850 553 850 Married Filing Jointly Taxable Income Up to 59 751 to Over Head of Household 59 750 523 050 523 050